Why You Should Choose Credit Unions for Financial Security

Lending institution stand as pillars of monetary stability for lots of people and communities, offering an one-of-a-kind method to financial that prioritizes their members' wellness. Their dedication to decrease charges, competitive prices, and customized customer support establishes them aside from conventional financial institutions. There's more to credit unions than just monetary perks; they additionally promote a sense of area and empowerment amongst their participants. By choosing cooperative credit union, you not only protect your economic future yet also end up being component of an encouraging network that values your economic success.

Reduced Fees and Affordable Prices

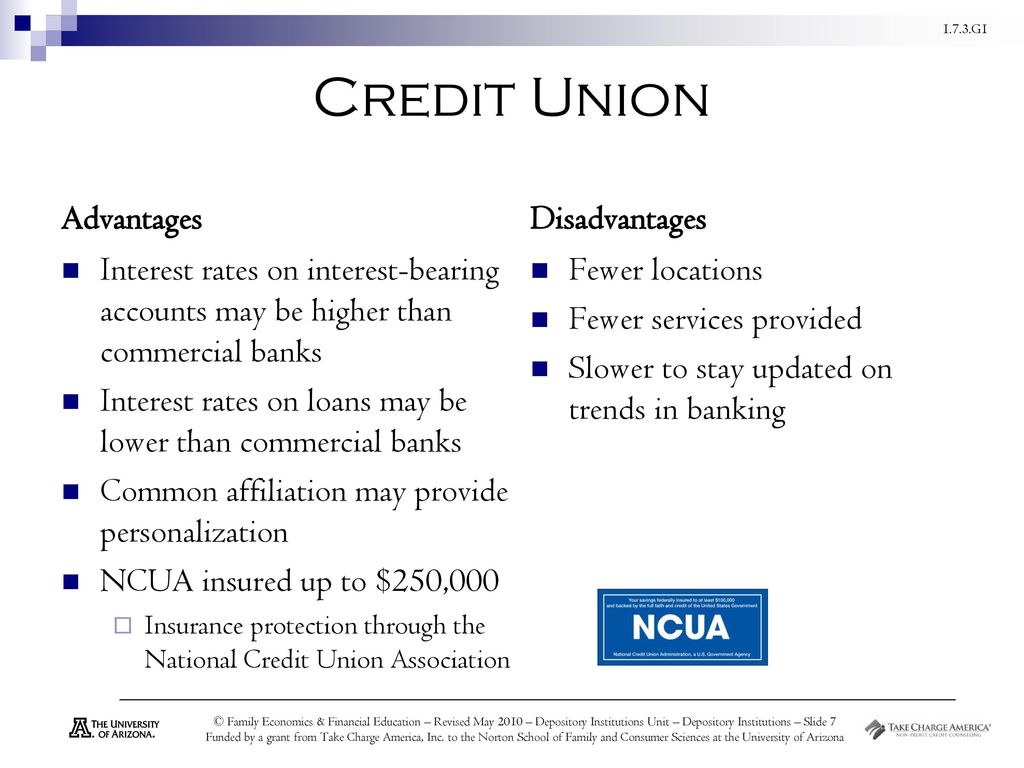

Credit history unions commonly provide lower charges and competitive prices contrasted to typical banks, offering customers with an extra financially stable choice for handling their funds. One of the crucial benefits of lending institution is their not-for-profit structure, permitting them to focus on participant benefits over making the most of profits. This distinction in emphasis makes it possible for cooperative credit union to provide lower costs for solutions such as inspecting accounts, interest-bearing accounts, and loans. Credit Unions Cheyenne. In addition, credit scores unions typically give a lot more competitive rate of interest on interest-bearing accounts and financings, converting to far better returns for members and reduced loaning costs.

Customized Customer Support

Providing tailored assistance and customized solutions, credit history unions prioritize individualized client solution to meet participants' specific financial needs efficiently. Credit scores union staff usually take the time to pay attention attentively to members' worries and offer tailored recommendations based on their specific needs.

Moreover, credit scores unions often go above and beyond to ensure that their members really feel valued and sustained. By developing solid partnerships and promoting a sense of community, credit history unions produce a welcoming setting where members can rely on that their monetary wellness is in excellent hands.

Strong Neighborhood Focus

With a dedication to promoting neighborhood links and supporting neighborhood campaigns, lending institution prioritize a solid area focus in their operations. Unlike traditional banks, lending institution are member-owned banks that operate for the advantage of their members and the communities they serve. This distinct framework permits cooperative credit union to focus on the wellness of their participants and the neighborhood neighborhood as opposed to only on generating profits for external shareholders.

Lending institution commonly take part in different neighborhood outreach programs, sponsor neighborhood events, and collaborate with various other companies to resolve community needs. By spending in the neighborhood, credit rating unions assist promote regional economic situations, produce job chances, and improve general lifestyle for residents. Furthermore, cooperative credit union are understood for their participation in monetary literacy programs, providing instructional sources and workshops to aid area participants make informed monetary decisions.

With their strong area emphasis, lending institution not just offer financial solutions yet also work as columns of support and stability for the communities they serve.

Financial Education And Learning and Assistance

In advertising financial proficiency and offering assistance to people in demand, debt unions play an essential duty in encouraging communities in the direction of economic security. One of the vital advantages of credit report unions is their focus on providing monetary education and learning to their members.

In addition, credit score unions frequently give support to members encountering financial problems. Whether it's through low-interest car loans, versatile settlement plans, or monetary therapy, credit score unions are dedicated to helping their members conquer difficulties and attain financial stability. This tailored approach sets credit history unions besides standard financial institutions, as they focus on the economic health and wellness of their participants over all else.

Member-Driven Decision Making

Lending institution equip their members by allowing them to proactively take part in decision-making procedures, a practice called member-driven decision making. This strategy sets cooperative credit union aside from standard financial institutions, where choices are frequently made by a select group of executives. Member-driven decision making guarantees that the passions and needs of the members remain at the forefront of the cooperative credit union's operations.

Ultimately, member-driven decision making not only boosts the general member experience however additionally promotes transparency, trust fund, and accountability within the cooperative credit union. It showcases the participating nature of credit report unions and their commitment to offering the best interests of their participants.

Final Thought

In verdict, cooperative credit union provide an engaging selection for financial security. With lower charges, affordable rates, customized client service, a solid area focus, and a dedication to economic education and support, cooperative credit union prioritize participant advantages and empowerment. With member-driven decision-making procedures, credit history unions promote transparency and liability, guaranteeing a steady economic future for their participants.

Credit rating unions stand as columns of economic security for lots of people and communities, providing an one-of-a-kind technique to financial that prioritizes their members' health. Unlike typical financial institutions, credit unions are member-owned monetary institutions that run for the advantage of their members and the neighborhoods they serve. Cheyenne Federal Credit Union. Additionally, debt unions are understood for their involvement in economic proficiency programs, supplying instructional resources and workshops to help community members make educated monetary decisions

Whether it's through low-interest fundings, adaptable payment plans, or monetary counseling, credit unions are devoted to assisting their members get over challenges and accomplish financial stability. With lower costs, competitive prices, individualized customer service, a solid neighborhood emphasis, and Wyoming Credit a commitment to monetary education and learning and help, credit score unions prioritize participant advantages and empowerment.